Save big on 2020 end-of-year equipment purchases.

As 2020 comes to a close, it’s not too late to take advantage of a significant year-end tax deduction on new and used equipment.

As 2020 comes to a close, it’s not too late to take advantage of a significant year-end tax deduction on new and used equipment.

If you're considering adding to your current equipment lineup, or refreshing your outdated equipment, these significant discounts make the end of the year the perfect time to make the investment:

Save big with a Section 179 Tax Deduction on the purchase price of equipment.

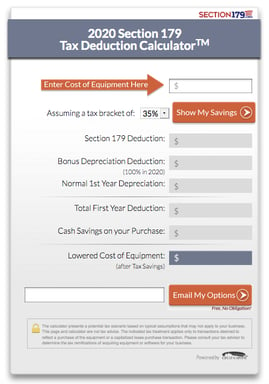

Thanks to the Section 179 Tax Deduction, you can restock your industrial pumps, mixers, and sprayers for fireproofing, stucco spraying, wastewater, and more at just a fraction of the cost -- usually around 35% less than normal costs. According to the rules of this deduction, equipment must be placed into service by the end of December 2020.

How much money can Section 179 save you in 2020?

|

See how much you can save with this calculator. |

Our team is here to help!

Request a quote today, or connect with your territory representative for more information.